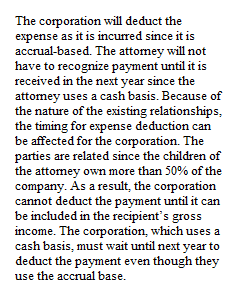

Q Lesson 7 Discussion Forum 3232 unread replies.9999 replies. Timing is everything. A self-employed attorney, who is a cash-basis taxpayer, performs work for a corporation that is an accrual-basis taxpayer and that is owned 100% by the attorney’s adult children. Assuming they both use calendar years, when can the corporation deduct the expense if it makes the payment in the next year? Why? Would your response change if the attorney was an accrual-basis taxpayer? And what basis might the IRS have for disallowing the corporation’s deduction? What substantiation should the corporation supply to overcome the disallowance? Guidelines for Discussion Each student must create one initial post for each of the above questions. Students should create a single initial post for each discussion. So, if a lesson has two (2) discussion questions, students should create two (2) initial posts. Students should respond to all questions asked to the best of their ability. Most questions are pretty straightforward or call for opinions with support, so students should be able to respond to all of the questions. All initial entries should be posted no later than 11:59 p.m. (ET) on Thursday of this week. You must reply to at least two colleagues by no later than 11:59 p.m. (ET) Sunday in a manner that extends the discussion. Discussions are set to post first, so you will need to post your initial reply before you can see the posts of others. Select the Options menu (?), then Show Rubric to see how this assignment will be graded. You may wish to subscribe to this discussion so that you are notified of responses. Your post should show original thought and be substantiated by content from the course readings or an outside source. All sources should be cited properly using APA format, Blue Book (Legal Citing-check chapter 16, or MLA format). A student must be able to substantiate their positions. Citing the Internal Revenue Code, Tax Cases or other authority will give a student a better score. To see the rubric for this discussion, select the Options menu (?) > Show Rubric. This topic was locked Feb 27 at 11:59pm.

View Related Questions